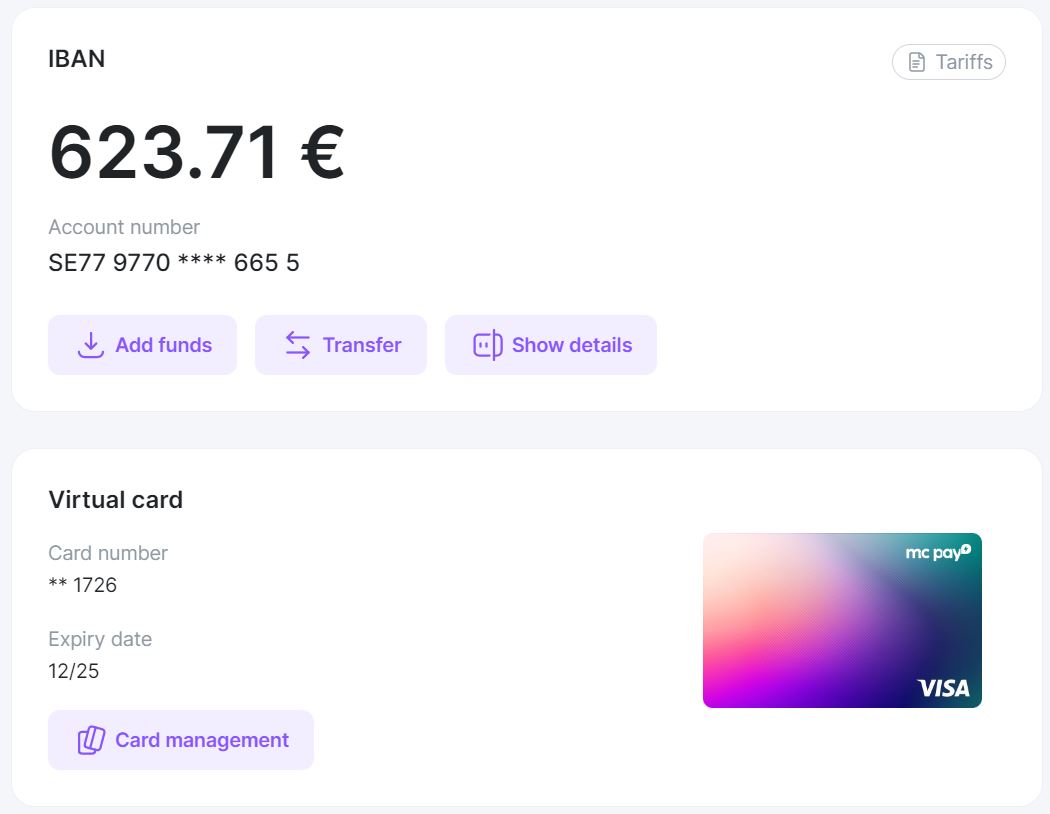

In MC Pay, you can open your IBAN and issue a virtual card linked to it.

Who can get an IBAN and card?

Who can get an IBAN and card?

Opening an IBAN and issuing a card are available to:

- citizens of countries in the SEPA zone;

- residents of the SEPA zone with a phone number in a country in the SEPA zone.

How much does it cost to open an IBAN and issue a card? Service fee

Opening an IBAN and issuing a card is free. The first month of service is also free.

IBAN tariffs

- Monthly service starting in the second month – €3;

- Monthly adding funds from the internal MC Pay account – free;

- Adding funds from other sources – free;

- Payment in SEPA – €0.20.

Virtual card tariffs

- Monthly service – free;

- Adding funds from other sources – 2% of the amount;

- Cash withdrawal from an ATM – €2;

- Payment – 0.2% + €0.2.

How money is deducted for service and use?

The service fee is deducted from the IBAN one month in advance. The first deduction occurs one month after the opening of the account. The next deduction is one month after the last service deduction. For example, if you opened an IBAN on June 10th, the next monthly fee will be deducted on July 11th. The next deduction will take place on August 11.

The fee for payments and cash withdrawals from the card is also deducted from the IBAN on the day the transaction is confirmed.

If there is not enough money on the account, the amount for monthly service will be deducted as soon as the money appears. If there is not enough money for three consecutive months, the IBAN will be automatically closed, and the amount of debt for three months of service will be deducted from the internal MC Pay account.

What IBAN and card transactions are available?

An IBAN can be used like any regular bank account: you can accept money and send payments. You can add funds to your IBAN from your MC Pay account or from external sources.

A virtual card can be linked to Apple Pay or Google Pay and used to pay for purchases in online and offline stores – wherever Visa cards are accepted. There is a limit on the amount of adding funds per day – from €2 to €5,000.

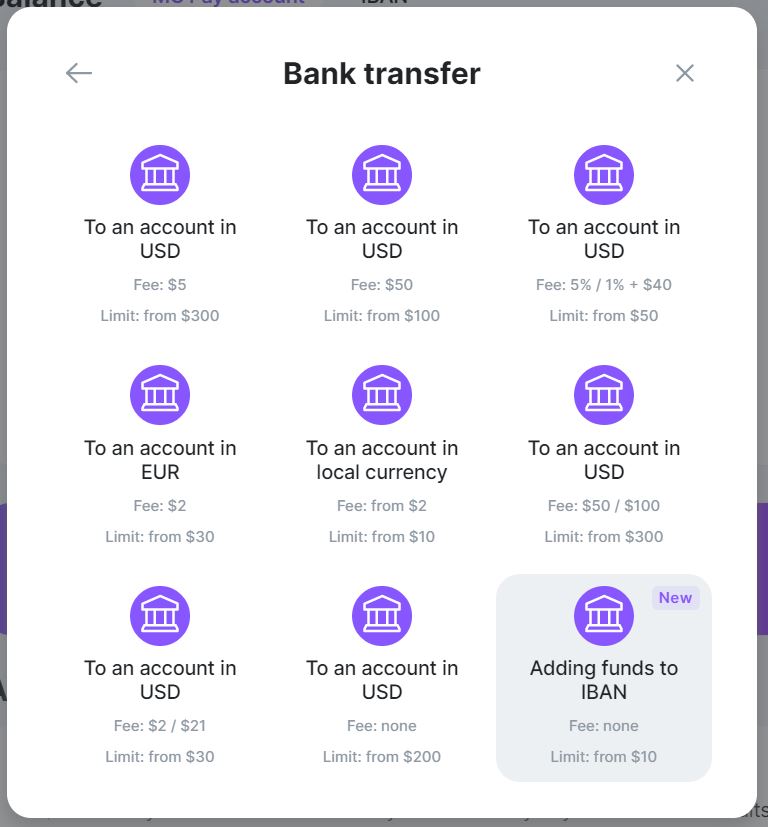

How to add funds to an IBAN from an internal MC Pay account?

There are two ways to add funds to an IBAN from your internal MC Pay account.

First way

- Go to the MC Pay "Balance" page;

- Click the "Withdraw" button and select "Bank transfer";

- Select "Adding funds to IBAN", click "Continue" and fill out the form.

Second way

Go to the MC Pay "IBAN" tab and click the "Add funds" button. Enter the amount and add funds to your account.

Is it possible to get a virtual card without opening an IBAN?

No it is not. The virtual card is linked to the IBAN, they have the same balance. You cannot issue a card without an IBAN.

How to open an IBAN?

To open an IBAN right in MC Pay:

- Go to the "IBAN" tab on the "Balance" page and click "Open an IBAN";

- Pass KYC verification;

- Wait for KYC verification to be approved. This usually takes several hours. As soon as the verification is approved, the IBAN will be opened and you will be able to use it right away.

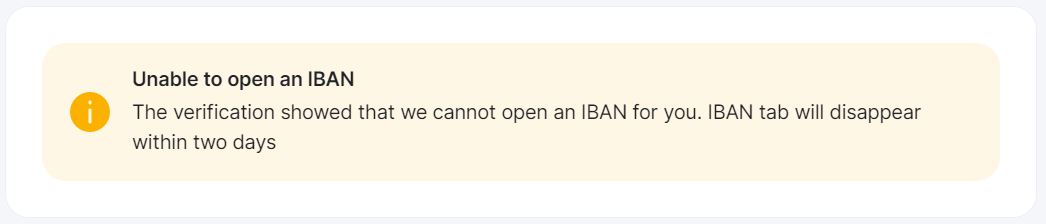

What should I do if the opening of an IBAN was denied?

Sometimes it happens that the opening of an IBAN is denied. If this happens, nothing can be done: you cannot re-verify to open an IBAN.

How to close an IBAN?

Write to support. The manager will close the IBAN at your request.

Also, the IBAN will be closed automatically if there is not enough money on it within three months to pay the monthly service fee. After the IBAN is closed, the three-month service fee will be deducted from the internal MC Pay account.